TL;DR: Americans now need to make $120K a year to afford a typical middle-class life and qualify to purchase a home. Minimum.

A friend was looking at getting a home lately and I offered to look into co-signing with them, so we gave our information to see what they would qualify for. With both of our details, they offered them a home loan of something like $100k, really not even enough to get anything that’s on the market now except for the worst crack houses possible. I then looked at what would be possible if I just applied by myself and if I applied for a home loan for a place that I would rent out. Not sure if it was considered a business loan, but I wouldn’t be the occupant, it would be an investment property for me. Suddenly, by myself, I qualified for a $300k loan, same loan agency, just different terms. I do have great credit, so maybe that helped, it’s just weird how they come up with the numbers sometimes. Like you would think two people together would qualify for more than what a single person would qualify for.

It’s a risk assessment. A low score as a primary borrower is more risky, even with a secondary borrower, the hassle to get paid if the first defaults isn’t worth it. Investment vs primary residence is also a different risk profile, you can assume some level of income from an investment property.

What’s to prevent someone from buying a house this way and then just “renting it” from themselves? lol

Generally, mortgages for your primary residence offer more favorable terms then ones for investment properties. The issue in the above story is likely related to the friend. If they had tried the same thing, their offer would likely have been even worse than what they got for a primary residence with a cosigner. Assuming they got an offer at all.

If you buy a house declared as investment, but you really intended to live there, it’s mortgage fraud.

You’re not renting it from yourself. You happen to be renting from a corporation that you happen to be sole director of. Gotta emulate what the rich do.

I mean, operated as an investment property they have near certainty you will have a stable income source (the tenant) so it makes sense that the loan value is higher. You’re guaranteed to have the income of the rent checks and just as likely all your other potential income on top of that. You actually can afford higher mortgage payments in that situation – and substantially so.

Which is a strong, strong, strong argument why all cities which have housing shortages (basically all cities) should be exercising policies that discourage non-owner-occupied properties.

What happened is that the other person apparently has absolutely terrible credit, so holy hell don’t cosign with him!

deleted by creator

Don’t cosign anything for a friend, ever. It will screw up your friendship.

If you want the results of the American dream the only way to do so is crime. Probably always been true, but boy is it truer than ever now.

It wasn’t perfect but there was dignity to being an American 24 years ago. Inequality is not helping anything at all

inflation has hit ALL industries

Yeah, back in my day. A simple theft only got you a few days in jail. With inflation, we’re looking months now for the same crime.

Shakes head

transportation costs, suppliers, loss prevention is not 100%, insurances, food, lower customer base due to inflation/ cheaper lower quality alternatives (goes hand in hand), office supplies/ services, etcetera

inflation has hit everyone even in the shady areas

Probably always been true

No, it really was true for a long time (as long as you weren’t a minority). Wealth disparity has skyrocketed in the last few decades. It’s why boomers can’t grasp that people just can’t afford to live–in their day, anyone who couldn’t afford to live was just plain lazy*.

*Wasn’t true, but that’s a whole other thing.

I achieved the American dream by leaving America.

I can technically afford my house and acre on my wife and mys income

Doesn’t mean I’m not currently planning and setting up my network of legit customers of shitake and no other mushrooms to help make sure I can survive, no sir

dont glamorize it man criminals get gulag /supermax

That or they get elected/promoted.

Here’s what happened in a nutshell.

Lyndon Johnson had great plans for the US, but wanted to win the Vietnam War with one huge push. That quickly turned into a giant quagmire. LBJ and later Nixon, ordered bombing of the North. That meant the US factories were working 24/7. Nice for factory owners and union workers, but LBJ was paying for it with paper money because he didn’t want to raise taxes. Ironically, Nixon ran for President as an anti inflation and pro peace candidate.

Nixon and Kissinger doubled down on the bombing and inflation started to spiral. Also, those factories were getting a bit worn down. Unable to met the deamnd for the bombing and supply foreign markets the US ceded local steel making to Germany and Japan. This is going to bite the US in the ass when the Arab Oil boycott hits. US steel is much more oil dependant than the newer factories, so suddenly Toyotas and VWs are the hot cars, and US manufacturing takes a huge hit.

Carter tried to control inflation and cut oil use, but got kicked out over the Iran hostage mess. Reagan came in and cut taxes for the rich. This increased the debt, but gave the economy an unrealistic jolt.

tl dr. In 1960, minimum wage was $1.00/hour. The average house was $11,000.00 and $1 million was considered a vast fortune.* Middle class meant a High School graduate with a Union job supporting a family of four.

By the time Nixon, Reagan and Bush Sr were done, ‘middle class’ was two college degrees supporting the house and $1 million was what a rich guy paid for a party.

- In case anyone tells you that $1 million is 1960 would be $10 million today, tell them that in 1960, $100,000 would buy a mansion in Beverly Hills.

$1 million today is still a vast fortune to most people tbh

I think most people would see the gulf between owning one moderately nice house and a small business [$1 million in 2024] and owning an estate with several acres and some horses, a half dozen cars, and enough in the savings account to keep a few families going. [$1 million in 1960]

The massive difference in the purchasing power of what the Official Inflation Figures tell us - when we used them to adjust an amount of money at a past date for inflation over the years and get a supposedly equivalent present day amount - is the same salary now as in 1960, shows just how fake Official Inflation Figures are.

The reason for Official Inflation Figures being so much bullshit and always on the understating inflation side, is because the lower the Inflation used in calculating the Official GDP figures, the higher that latter figure gets.

All that talk of GDP Growth in the last few decades is the product of some very consistent (and hence likely purposeful) understating of the Inflation so that the Maths used to produce the Real (i.e. Official) GDP output a higher number hence politician can proudly declare GDP is growing strongly.

As Mark Twain once said,

There are lies and there are big damned lies, and then there are statistics!

If we hadn’t had Wilson we wouldn’t have had Hitler, or Stalin. We may not have had Nixon and Reagan…

Lyndon Johnson had great plans for the US

I recently learned that Johnson’s “Great Society” plan was partially a continuation of Kennedy’s “New Frontiers” plan (which he wasn’t very successful in pushing through Congress before he was assassinated).

LBJ is probably the most WTF President of the 20th Century. He pushed the Civil Rights Act, and created the Vietnam fiasco.

I like this story. Someone who worked for Kennedy and Johnson put it this way; if JFK came into your office and saw you reading he’d assume you were working. If LBJ saw you reading a book he’d think you were goofing off.

It died along time ago with the dreamer.

Kill zoning and get lower prices.

Smith explained how, just a few years ago, $60-$70K a year would have been sufficient to qualify for a home.

“Most people are carrying student loan debt, which is at an all-time high, and the average payment in the country is $500 a month for your college degree. [There are] some people I’m seeing in my comment section saying ‘$500, I wish, it was $1,200 a month for me’,” said Smith.

“If you are someone who bought a house before 2020 and you have it paid off or you have a 3% interest rate, you are not burdened by the housing costs like the 2024 adults are now,” the relator said, explaining how debt, especially college debt, housing costs and childcare are burdening millennials and Gen Zers starting their lives.

It’s scary how everything seemed to change so fast, yet the ingredients for this very situation have been simmering for some time. It’s no coincidence that since student loans ballooned it didn’t take much for the dominoes to really begin to fall and have drastic effects on everything else downstream.

At least part of the equation is that Trump pressuring the Fed to lower rates (that were already historically low in the first place) to add even more fuel to what already was an overheated market prior to COVID completely wrecked the housing market for the foreseeable future.

I bought in 2020 and I’m glad I did because if I hadn’t I would’ve likely been permanently priced out.

Yeah, I bought a couple years before and I’m glad I did, but it’s really sad to think of everyone who couldn’t or didn’t for whatever reason.

Everything is so messed up now and the uncertainty will probably continue for awhile.

With the average cost of a house

Every fucking time with this shit.

The average price isn’t the price of a starter home, why do people fall for this clickbait.

That’s like trying to use the average price if a car as your starting point for how much you need to make to buy your first car.

Which means about the halfway point between a 1k beater and a fucking 200k rolls royces is what you are pretending a starter car is.

“Oh man the average price if a car is like 80k no one can afford to buy a car”

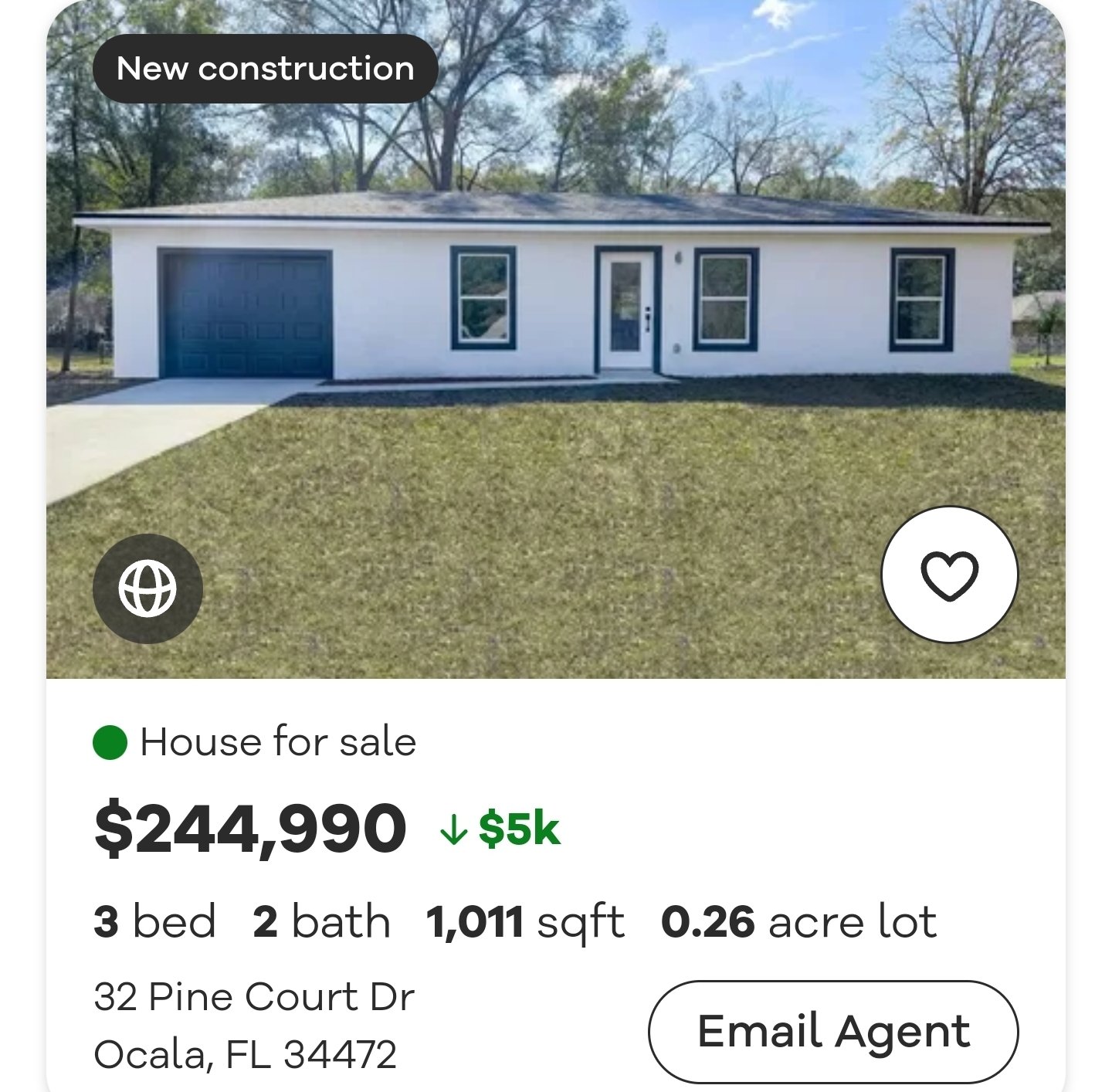

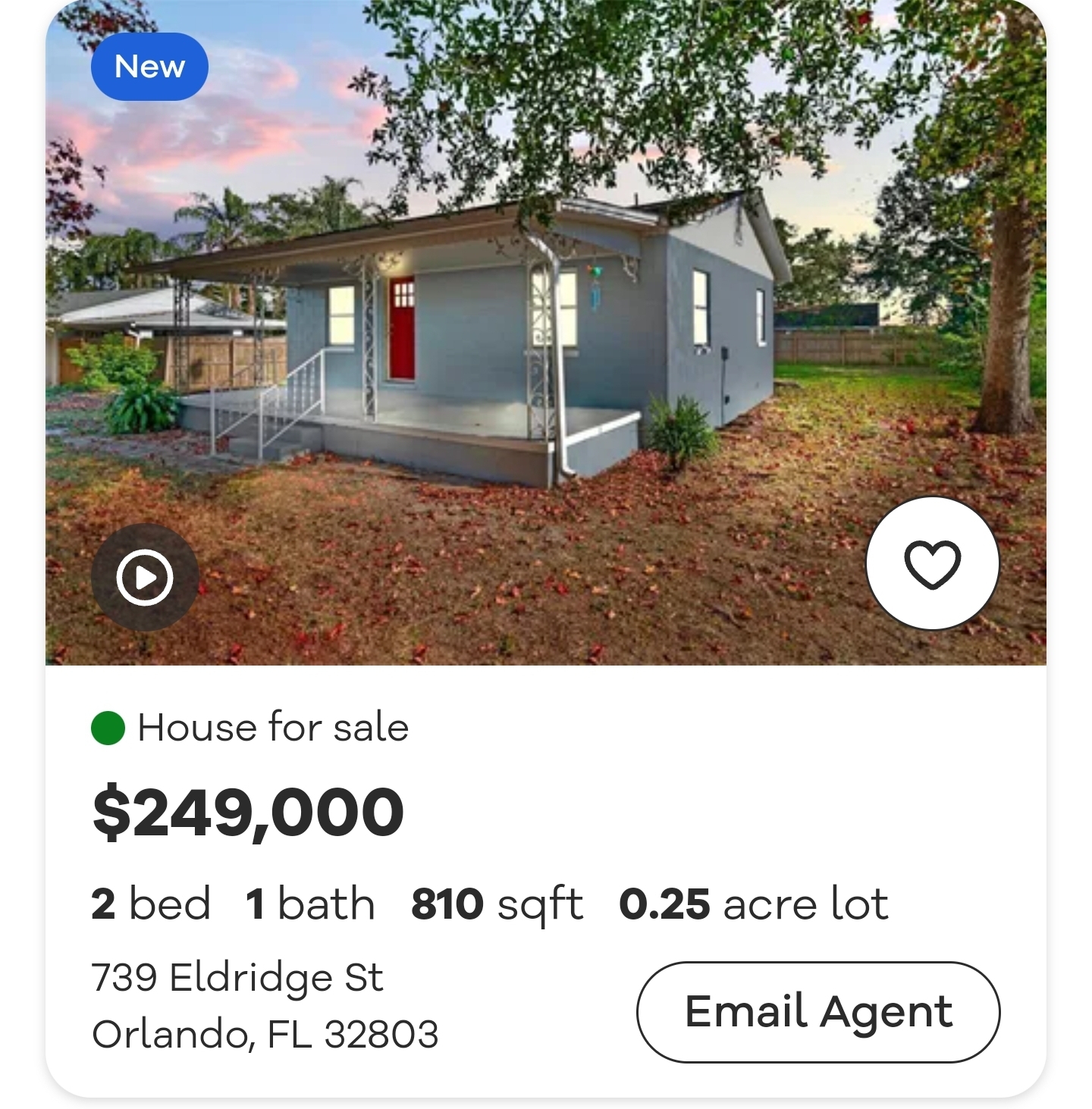

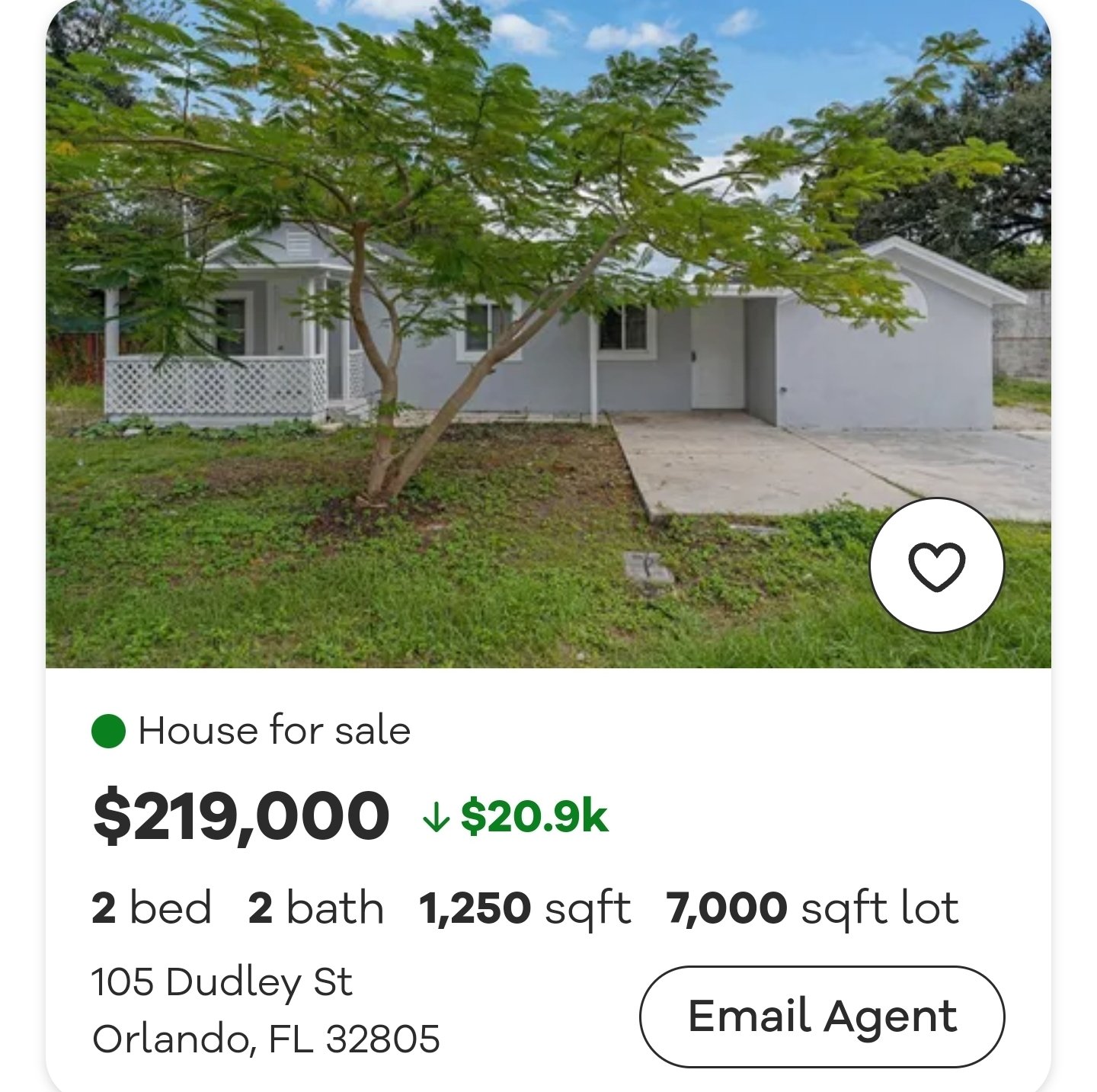

People are so stupid about this. You can get homes for like 200k to 250k in most major cities, that aren’t prime locations but 100% liveable and not a total dump, just need some work. That’s not even bottom of the barrel, you can go way cheaper if you want a total dump.

Everytime you see click bait like this, step one is Ctrl+F for the word “average” and you’ll find it everytime.

Do you think starter homes didn’t go up? Talk about having your head in the sand. Open a real estate website, the average person can’t afford what they used too, it’s that simple.

I shared this article because I have first hand knowledge of the Orlando market. Can you find homes in the 200-250k range? Yes. Should you live there? I wouldn’t recommend it. The minimum for a starter home in a relatively safe neighborhood is about ~300k and it probably needs work. Also, if you read the article, home prices aren’t the only pressure pushing the salary requirements up. That said, you have the right to believe what you want but as someone who recently purchased a home in the area, I think the author was fairly dead on.

He’s catching downvotes like crazy, but he’s 100% correct that average is a poor statistic for comparing things like home price and salaries. More specifically, average is typically used as a shorthand for “mean”, when what’s really useful is the median.

Median home price (or median salary) for that matter, will much more closely reflect what the typical person is paying for a house, while mean is going to be skewed by the long tail of expensive prices.

And also to back up Pixxelkick, that single number still doesn’t accurately reflect the situation for first-time home buyers, which is the demographic these articles tend to focus on when bemoaning high home prices.

So it’s not like anyone’s saying home prices aren’t going up, and there aren’t problems with that, but it does get really annoying to see these articles CONSTANTLY peppered with misleading or irrelevant statistics by authors who either don’t know what they mean, or worse are exaggerating to drive clicks.

I think he is catching flack for dismissing the article and making statements without a split second worth of research just because he doesn’t like the use of the word “average”. Below are all the “homes” in Orlando for $200k or less. Going up to $250k doesn’t make it much better.

Way to try and skew the results, took me 5s to find these on page 1 by just clicking to filter off foreclosures.

SMH, all these look just fine to live in, they are a bit old but the inside pics look quite well maintained and cozy.

I am not skewing the results. You have just decided that you are right even though you don’t have enough information to back up your claims. Remember when I typed this?

Can you find homes in the 200-250k range? Yes. Should you live there? I wouldn’t recommend it.

Of the four houses you listed, I recognize three of the street names and the third is in Ocala. Unless things have drastically changed since 2019, and they might have, you might want to be extra vigilant about your safety. Investment funds have been buying and flipping houses in some of the most crime riddled neighborhoods. So basically, you are spending $250k and betting that they neighborhood will turn around. It might, but it might not.

For context, those houses were well under $100k in 2015. Let us use one of the homes you listed (739 Eldridge St, Orlando, FL 32803) as an example. If you had just scrolled down you would have seen the valuation history.

It is OK to admit to be wrong and accept points of view from people that have more information and context than you. It is a great way to learn and expand your world view.

For context, those houses were well under $100k in 2015

That’s nearly ten years ago mate, lol

You are being purposefully daft and you’re just embarrassing at this point. Look at 2020, or just wrap yourself in your warm blanket of ignorance. It’s your life.

The 2 “houses” in the second image being listed for 200k are fucking insane.

Those two “houses” are almost $50k more than what I paid for a fully remodeled home for my aunt right before the pandemic. They are also in a significantly worse neighborhood.

Yes but why on earth would you want to live in a crap house in Orlando for that price? There are way more affordable locations and Orlando is pure swamp ass.

Yup, leave it to Fox Business to convey skewed information in a manner that elicits engagement through enragement

This isn’t just fox, this is every single media outlet and tik tok influencer and YouTube preacher everywhere, it’s a constant falsehood.

This happened because people were lulled into voting for the very people who gave their fair share of corporate profits to the rich. Looking at you, Republicans, especially Ronald Reagan.

And they’ll do it again.

You can argue that Democrats inability to support the working class and unions helped to kill the American dream. “Both sides” are capitalists.

Hell, Clinton essentially adapted Reaganism for the Democratic Party.

I didn’t expect upvotes. It’s an election year for christ sakes.

At least on lemmy, more people understand dems v repubs isn’t left v right, it’s mid right v far right.

Don’t blame me I voted for Kodos

Lemmy is a leftist haven

deleted by creator

How close are you to a superfund site?

i dont mean to pry, but i have been trying to work out how i can do this for myself so id be interested how you were able to do it.

im not asking for your life story, and obviously share what youre comfortable with online, but some helpful info would be your salary range, location and cost of home, and down payment (even as just a percentage of the total home cost).

other useful contextual information would be how long it took you to save up for the down payment, whether you did so while paying rent, if you had any other assitance with the down payment (personal loan, gift from family, borrowed against your 401k, etc), state of the home (move-in ready/fixer upper/built yourself), whether you used the loan to acquire furniture, etc.

sorry if thats asking too much but id like to use you as a data point, even if just for myself, and i do need a bit of data to do that.

Congrats. Do you live in Central Florida (Orlando area)? How much student loan debt do you carry? The article was fairly specific about that $125k. I’m pretty sure you can buy a home and live well within your means with much less if you lived in Gray, Louisiana.

One thing that the author is not taking into consideration is the post-pandemic ability to “work from home”. Gray, Louisiana is 45 minutes away from New Orleans and five minutes away from Houma. You can buy a 4Bd/3Ba 2100sqft brick house there for $165k. Crimenis relatively low and there is a university close by. You get the full suburban treatment for cheap…but you have to have a skill set that allows for remote work.

but you have to have a skill set that allows for remote work.

And then you have to live in Gray, Louisiana.

That’s anecdotal. The study is an average. That’s like saying, “I’ve never been homeless, so obviously homeless people don’t exist.”

Where are you at?

This is what happens when most people think the disparity in wealth should grow.

It does.

Lol I was making nearly twice that before a layoff and still couldn’t afford a condo that amounts to half or one third of a house in the neighborhood I live in.

You were making 240k and couldn’t afford a condo?

210k.

Condos in my area, part of Greater Boston, are going for $1.1mil at least, usually more in the $1.4mil range.

Even if I could somehow scrounge together 20% down that’s monthly payments of over $7k at today’s interest rates. After taxes 210 is more like 126, which is monthly a little over $10k. If I’m not saving anything for retirement and basically barely holding together the rest of my expenses and hoping to God nothing happens to my car, my body, my dog, my cat, or the condo, then I could afford the monthly payments.

Now imagine if I had jumped into that situation and then gotten laid off, like I was.

EDIT: it’s worth clarifying that in big cities, the points talked about in this article are still true, just scaled up. Adults in their late 20s/early 30s working in tech are easily making 150k+. College grads in Computer Science are getting 6 figures easily. Making $200k was the high end of average but nothing unheard of.

And the prices here adjust to that, happily.

That 120k a year is still assuming you buy a house on a long term mortgage.

It even says 120k to qualify, not actually comfortably buy.

also out in the Boonies

Smith explained how, just a few years ago, $60-$70K a year would have been sufficient to qualify for a home.

Yeah, no. It was more than a few years ago.

I think that this has been trouble since 2007. Financial institutions went from giving lots of home loans to only giving corporations and the elite loans.

2007 was 4 years ago.

checks math

Everything checks out here

I don’t have a full Orlando market research report but pre-pandemic (2018) you could get a house in my neighborhood (Davenport) for $265k-325k. In 2024 the starting price is ~$650k. In 2018 I bought a house (Orlando) for my aunt to live in for $150k. After buying the little bungalow, I saw the rest of that neighbohood get gobbled up by investment funds and now it is almost completely rentals. The current comps have it at $325k.

Homes were dirt cheap from 2009 until about 2013, but everyone was broke. Prices were reasonable from 2014 to maybe 2018 (maybe). The post lockdown boom and investment fund buying spree has been insane.

But then you would have to live in Davenport. I’ve never seen a more literal suburban hell. 30 minutes of side streets to go anywhere without traffic.

You are not wrong.

I will repeat this here:

While there are a lot of factors, you really cannot understate the size of the homes being built in the US. We are building homes nearly 3x the size (despite cost per square foot only going up slightly), and pretending it has no effect on housing costs. It’s actually pretty insane.

You guys really do build giant soulless houses in empty suburbs and think that living in an apartment is a crime against humanity

Because living surrounded by lifeless cement is crime against humanity. People need home, not voluntary prisons.

Average suburbanite before he goes on a 6 hour trip to the grocery store

You can have houses without sprawl.

Both apartments and houses have their merit, both can exist as a viable shelter that fulfills people’s needs. We don’t need to argue over which things corporations and greed took from us is better.

I would love to live in apartment if every one I ever lived in didn’t have neighbors blasting their music at 3am.

Poor tax laws on the richest 1% killed the American Dream.

Sufficient application of guillotines will restore it.

wow thats archaic we use the Puyi method now dude

Puyi

death by kidney disease?

Capitalism did that too. Capitalism is in a constant state of decline with short upward bursts of innovation that too will decline. Enshittification infects all.

My wife and I manage it because we both work.

I didn’t intend on marriage as a way to own a home but I couldn’t do it without my partner.