Car companies typically use TransUnion and they are normally higher than the other 2.

Same here, paid off a 6 year in 2, score dropped 54 points.

Surprised all my student loans didn’t buffer it a bit those are very old.There are numerous proprietary score algorithms out there. The newer ones seem to have fixed this bug by factoring history of closed accounts but many online “free credit report” services still use the old ones.

Old algorithms would often penalize account closure due to sudden reductions in average credit age, available credit, or credit mix (any of which might apply to the OP, but especially if that car loan represented a significant portion of their credit history).

Likewise, they would sometimes reward new debt if it significantly increased available credit or added a unique credit type to the mix. For example, a first mortgage could bump a credit score by 30 points or more, even though the individual is no more credit worthy than they were before.

Regardless, I think a good thing to keep in mind is that banks tend to maintain their own internal scoring systems. So not only is there no such thing as “THE score,” but the scores people are referring to when they say that are mostly just one credit bureau’s estimate, based on their proprietary rubric, of how a lender MIGHT see a potential borrower’s likelihood of default.

The banks often use the score by such scoring companies, as those scoring companies have access to all sorts of contracts, bank accounts etc. you have. Wheras you bank only has information provided directly by you.

The scoring companies can have tremendous impact on your life and often they use completely bullshit factors, like your postal code, where you are punished for living in a “poor” neighbourhood or rewards for living in a “good” niegbourhood.

There is also credible reports of ethnical discrimination, e.g. if your name is not a “white” name.

The scoring companies should be obliged to provide full disclourse for how they define a score and banks should be demanded to provide information, if they denied a credit based on such a credit score, with full liability of the scoring company, if their score was using discriminatory criteria.

The banks often use the score by such scoring companies, as those scoring companies have access to all sorts of contracts, bank accounts etc. you have. Wheras you bank only has information provided directly by you.

At least in the US, banks see the full credit report you see, not just a number. Using any of the specific scoring models (FICO X, VantageScore X.0, etc) that are championed by scoring companies or the various US credit bureaus is entirely optional.

The scoring companies can have tremendous impact on your life and often they use completely bullshit factors, like your postal code, where you are punished for living in a “poor” neighbourhood or rewards for living in a “good” niegbourhood.

This is quite a claim. How easy would it be to detect and verify that credit bureaus are using borrowers’ associated addresses substantively in their nationally deployed scoring models? I’d wager a college student with an excel spreadsheet and a one-line mailer could do this in a single semester. Now consider the CFPB auditor, with direct records access. How long would that take?

There is also credible reports of ethnical discrimination, e.g. if your name is not a “white” name.

Again, I respectfully suggest thinking these conspiracies through. Credit reporting agencies are fancy bookies in the end, right? They live and die by the legitimacy of the service they offer. So if one of their scoring models has worse predictive accuracy because it’s evil, few banks will use it. Not even because it’s evil, just because it sucks.

The scoring companies should be obliged to provide full disclourse for how they define a score…

They are. In the US, it’s the Fair Credit Reporting Act. In Germany, I think it’s tied to the EU Credit Servicers Directive.

I don’t enjoy defending credit bureaus of all things but conspiracy theories like the ones you’ve described distract from real systemic injustice and disrupt real collective action.

Edit: changed localized phrasing and content so as to not accidentally come across as disrespectful or dismissive.

Well in Germany there is currently an ongoing dispute because the main credit scoring company refuses to disclose the details of its scoring algorithm.

I would also disagree on the banks interests there. The banks don’t see the customers they loose because of an overly restrictive scoring model. Also for them to see things like discrimination based on names they first would need to develop a sense to question their own prejudices. Something that white people in Germany, and given the constant issues of racial discrimination, i’d dare to claim in the US too, struggle with extensively.

I want to ask on this though:

At least in the US, banks see the full credit report you see, not just a number.

Do you mean the report provided by the scoring company? Or is there a national register, where all your contracts, credit cards, bank accounts etc. are stored and all banks can access it? That is what i mean. W.o. the scoring company, the bank only knows about the business you have with them and what you disclose to them. They don’t know wether you have an overdrawn credit card with a different bank. At least that is how it is in Europe.

I hadn’t heard about the dispute in Germany but found some articles about it. If I’m reading correctly, I would say practices were definitely not more responsible in the US, but the history of disputes here may go back a bit further, with a slew of regulatory reforms we benefit from today — namely FCRA, TILA, BSA (1968-1970), ECOA, FCBA (1974), RFPA (1978), and FACTA (2003).

For them to see things like discrimination based on names they first would need to develop a sense to question their own prejudices.

I definitely agree regarding the universality of blindness to such biases. I suppose automated credit decisions (based purely on scoring models) might have a better shot at eliminating the factor of implicit biases in human agents. Even so, there is a lot of debate over here about how best to filter data that reflects biases and also what data is currently being ignored due to biases, because any algorithm that solves these issues, in part or whole, allows better value capture and increased revenue.

The banks don’t see customers they loose because of an overly restrictive scoring model.

Perhaps, but even if their stakeholders don’t notice or care about discrimination at all, they do take notice when a competitor scoops up a portion of the market they failed to realize due to biased/inferior analysis. After all, the original goal of credit scoring was to increase objectivity and predictive accuracy by reducing bias for the sake of better (more profitable) lending decisions.

To your question re: the credit reporting system in the US, it sounds like it works a bit differently here. There are credit bureaus (sometimes called “reporting agencies”) such as Experian, TransUnion, and Equifax (“the big three”). They functioned historically as lending history aggregators, but now also have scoring models they develop and sell. There are also companies who specialize in scoring models, but they use data from the credit bureaus. These companies often tailor their models to specific markets.

In general, if you apply for any form of credit, the lender formally submits a requisition (a “hard inquiry”) for your file (a “credit report”). Only very specific information is allowed in that credit report, and it must be made available to you at your request (free annually, otherwise for a nominal fee). There are other situations where credit scores can be ordered as a “soft inquiry” without the report, and there are particular rules and restrictions that apply, but the lending history contained in your credit report is what banks and lenders routinely use for applications, even automated/instant credit decisions.

One hole in your “if it’s terrible banks wouldn’t use it” Equifax still exists

I missed a credit card repayment by 1 day and my score dropped almost 300 points (UK. 800 (very good) -> ~500 (below average))

That’s very unlikely, there’s more to that than you’re letting on. Was the card maxed? What was your total utilization?

I’d say inb4 someone high on copium tries to justify it, but I’m already too late.

Tell ya what, I got a plan! We go back to the way it was before credit scores. If you’re white, socially acceptable, know your banker and are a deacon in your church, you’re approved!

“nOt LikE thAT!”

Children: I don’t understand how this works so it’s unfair!

Normal countries don’t have credit scores. It’s once again a US-only problem.

Lmao what? I’m from a third world country and credit score is a thing here.

USA?

DAE that USA iz a third world country. I iz a geneus.

🤦♂️

Come live in an actual third world country, live the way average citizen in that country live, and you’ll be yearning to be in USA instead by week 2.

Fuck this dumb circlejerk.

Wait… Seriously?

I knew it was ridiculous (literally two companies who assign you a numeric value in an arbitrary range and refuse to elaborate why)

But I never considered other places not having some version of this, probably run by the government (or are just using ours)

Can you walk me through how getting a loan works? Let’s say a home loan, what would they ask and what decides the terms you get?

I’m not the person you asked but there aren’t credit scores where I live (Netherlands).

First of all when you take a loan it’s officially registered with the Bureau of credit registration. Yes paying of a loan nicely will still help but not having any loans at all is usually better. If you already have a loan you can’t loan as much money. So there’s some kind of system but generally loaning as little ad possible is much better. There’s no score though, just positive and negative registrations. Every loan above 250€ is registered. This includes stuff like a phone subscription with included phone.

Besides that if you want loan the lender will ask for income and expenses.

Also almost nobody ever uses credit cards. We all just use debit cards. So you can’t spend what you don’t have.

Just because the old system was worse does not mean we can’t have better than the current system.

Some people love taking time out of their day to type out at least one full paragraph on why this is okay and makes sense! When we know it doesn’t, but they sure try their darndest to justify it.

What a waste of time and nonsense.

I find that my score drops roughly twenty points, and stays there for a couple months any time I’ve got a zero balance on my credit card on statement day.

I returned an $1,100 generator in January, resulting in an enormous negative balance on statement day.

I suspect my credit score will be down to zero this month because of it.

As a general rule, I pay my credit card off three or four times a month, making sure to leave five or ten dollars on there for statement day. It costs me zero interest to do this. It’s just stupid that I need to do it.

You can pay the entire statement balance and not pay interest. I have mine set to autopay tge full statement balance every month.

They know that

I don’t thing they do, as doing so does not result in zero balance on statement day, nor does it require paying the card 4 times a month, nor does it incur interest. Unless they just like doing things the hard way then complain it’s stupid they ‘need to do something’ they don’t need to do.

I think you misread what I wrote, but thanks.

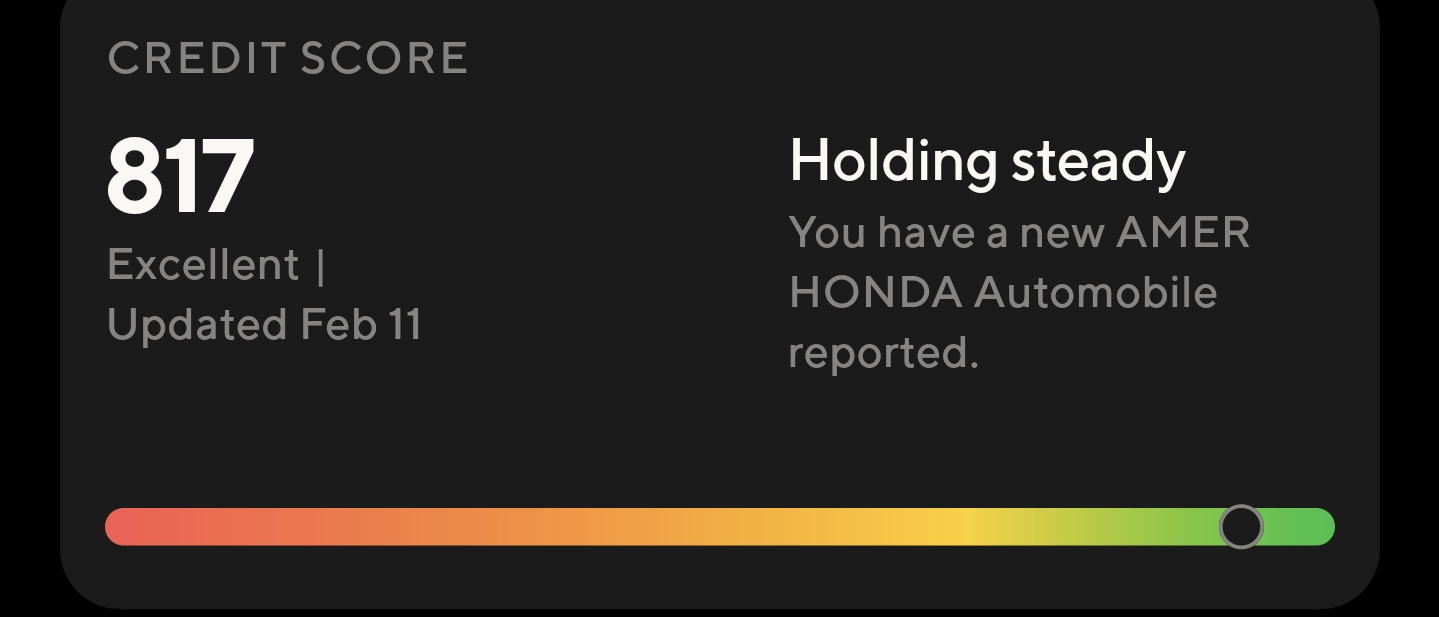

I basically never have a balance on my statements, but score has been stable at 821 for many years. I even got a car loan this month and it only dropped to 817.

Yeah, keeping a small amount on the card will help, but that’s really only to eek out a couple of points. I don’t bother trying to min/max that much and my credit is 821/823 TU/equifax

Mine is generally the same as yours, but I can track back for years and see correlation with drops down to 800 or even 790 every month I’ve ever had a zero balance. I mean, it’s really all vanity, but I had shit credit when I was young, so it’s wired me to constantly monitor my score in my later years.

It’s ok, rich people don’t have to play by this system, so that makes it all better, right?

It is bullshit, but there are ways to game the system. Essentially, a higher credit score means you’re a better mark for creditors. It means you pay your bills, but you’re never debt free. In order to maximize your gains and keep the capitalist machine running, you always have to be leveraged in some meaningful way. Basically, if you’re really poor, you’re fucked, but if you can somehow manage your bills every month and put your normal expenses on a credit card of which you never use more than 50% of your limit, your score will go up. Finish paying off a car? Finance a new car! It’s ridiculous, but that’s what they want us to do to keep the ruling class in power.

You’re absolutely right.

Basically your credit score is some amalgam of how much credit you have available, vs how much you owe, and whether or not you pay your bills. If you have available credit and you have never used it, you suck. Giving you credit won’t get the lender anything for their trouble. If you have a little debt, and you consistently pay it (read, pay them interest), then your score goes up because you’re paying your creditors, so other creditors know that you’re a good source of income for them.

The only thing that having a good credit score does, is give banks and institutions information on how much they could possibly wring out of you.

My score should be through the roof, but I’m too leveraged, I have something like 80% usage of my available credit. But I have a nontrivial amount of debt that I have carried for years and I’ve (sometimes painfully) always paid my bills on time.

My suggestion for anyone currently carrying significant debt trying to pay it off and increase their credit score: pay more than your minimum and take every offer they give you. If some institution says you’re pre approved for some loan device, say yes. Even if you just throw it in a drawer. It will increase your total available credit driving down your occupied credit % and driving up your credit score.

Filling out every loan offer is insanity.

I would agree that the system is insane.

If you’re trying to build your credit score, having a bunch of credit that you’re not using can help very much.

That, in and of itself is the key: having credit that you’re not using.

If you immediately use any credit you claim, then you’re going to eventually sink (go bankrupt), which takes 5 years, sometimes longer, to clear from your credit score.

The insanity of the system is evident. Understanding what the credit score really means, can inform your decisions about how to best maximize your score, if that’s your desire.

I know people who are classifiably wealthy with terrible credit scores because they’ve never needed credit for anything, so they don’t have any credit sources and certainly have not ever held a balance on a credit account for any length of time. So they look very bad on paper to creditors. Consequently I know very diligent people who are remarkably poor by comparison with near perfect scores because they know how to game the system in their favor, and do everything the way creditors want it to be done. They’re never so leveraged that it negatively impacts their score, they have plenty available and they’re never so much in debt that they can’t pay their interest.

It’s a stupid system.

I’m not saying the system isn’t stupid, I’m saying that blindly applying for every credit offer carries risk in and of itself. Plus hard credit pulls will temporarily hurt credit scores anyway. I just wanted to caveat that piece of advice for folks because I think being cautious and intentional with personal finance decisions makes more sense.

That’s not what I suggested. I’m speaking more on the lines of being pre-approved for credit, which usually doesn’t require a hard credit inquiry.

Usually your own bank will do stuff like this, or financial institutions that you have history with.

Credit increases and new forms of credit that are pre-approved are generally what people should focus on, not filling out applications for credit as much as possible.

Such offers are not frequent as long as they’re genuine, and usually result in a reduction in total credit utilization, which leads to a better credit score.

I also agree that filling out requests for credit without being promoted by your existing financial institutions can be detrimental, at least in the short term.

My credit isn’t perfect and I’m continually trying to improve by paying down my loans and credit accounts to try to get them to and keep them below 50%, but if my bank sends me an offer for a pre-approved card, I’ll go ahead and accept. When it arrives, I’ll activate it then toss it in a drawer and do everything in my power to never use it, simply to get that utilization number under 50% and keep it there.

Normally it would be. For anyone in the position of barely treading water financially it’s a sound strategy.

The key is to claim the offer, but not use the financial resource. Just use it to boost your available credit and decrease your overall debt used.

If you claim it and immediately spend it, then you’re only going to hurt yourself.

I can’t speak for anywhere else but credit scores are more or less bullshit in Australia.

As in, of course if you have outstanding bills or a legal claim against you no one gonna lend you money. You don’t need a score to tell you that.

Similarly, if you’ve got enough money for repayments banks want to lend you money.

Anything in-between is about specific problems. An unpaid bill, not enough income, whatever.

The actual credit score isn’t important. It’s more like marketing - get a credit card to improve your score.

Also in Australia, no idea what my credit score is. I admit I am unusually lucky, tho. Have only had one loan in my life, with which I bought my first real car over a decade ago.

All I’m hearing as an American, is that Australia is a good place to retire.

We have our own problems, but we’re mostly chill over here.

The numbers Mason, what do they mean?

+35 social credit

My credit score is just under 750 right now and I haven’t had any significant bills for a while. It’s all because I co-signed with a loan my dad got that has been counting toward it.

I still can’t open a line of credit above $350 tho. That score is so bullshit.

It’s because you don’t have any credit history (the co-signed loan doesn’t fully count). Go get a credit card and pay off the full statement balance every month. That will build credit history and account age. DO NOT carry a balance, that incurs interest. Simply pay off the statement balance every month when the bill comes.

My uhm, social score… cough, I mean credit score is very good right now. I’ve been a good little capitalist.

*score goes down 17 points for coughing*

insurance goes up $50 due to preexisting condition

LEMME OFF THIS FUCKING RIDE ALREADY!!!

ooh this reminds me I had a coworker confidentially tell me credit doesn’t go down after closing a line! I know in the long run it’s beneficial but when living paycheck to paycheck it’s not very easy to think about the future :)

I have refused to talk to her since lmao