Finance

gurugrifter Dave RamseyFTFT.

I like to imagine this means “fixed that for thee.”

You aren’t working your way into home ownership in many cases unless you also work your way into a different locality as well.

I bought my small 2x2 condo for around 500k in 2020, it’s now worth ~800k. Housing inflation is out of fucking control.

I’m moving into a house (renting) soon, and the owner bought it 8 years ago for $185,000. It’s now “worth” over $400,000.

The only homes in that price range here are an hour away from where I work.

I know a karate instructor that just bought a 2br 2ba house for 40k, in Tucumcari new mexico

There is affordable housing out there, but you really have to search, and you have to be flexible.

I’m not saying there isn’t a shortage or that prices are inflated. The problem needs fixing.

Very true, if I could work remotely I could easily afford a good size home just a little out of the DFW area.

What if switched jobs, even to a different line of work. DFW, and all of metro Texas is pretty expensive.

I spent most of my career in Houston. We bought a lot of expensive houses and expensive cars. Honestly I never expected to live this long. I really wish I would have stashed money away to live the life I’m living now.

Dave Ramsey is one of those guys where you have to eat the fish but leave the bones.

A lot of what he teaches is really great, practical advice–aimed at people who really might not understand financial basics.

Things like budgeting, saving, investing in mutual funds, and avoiding debt like the plague. That’s all fantastic financial advice. The whole "borrower is servant to the lender stuff pulled right out of the Bible is stuff that most on here would agree with. Debt is a way to force people into financial serfdom.

But occasionally he says stupid shit like this. And maybe it’s taken out of context, but probably not. He always has advocated busting your ass to get out of debt and start saving. He calls it getting “gazelle” intense about it(basically saying banks, lenders, etc are lions trying to kill you). Again, not too far off from whatost people agree with.

So, he’s advocated getting multiple jobs if you need to until you can right your financial ship.

But he’s also an proponent of advocating for yourself and getting better jobs and ditching the second job as soon as you can. So I dunno. He says dumb stuff but he’s also pretty practical overall. Like I said eat the fish, leave the bones.

His “no debt” spiel is a decade out of date. The red queen paradox applies here, most people need to run as fast as they can, just to stay in the same place.

The average house here has gone up in value 55 euros a day for the past decade, and rent has risen faster Unless you’re already doing very well, you cant budget your way into buying a house anymore. Saving 55 euros a day for a decade means you’re standing still, you need to MORE to actually get closer to buying property.

Again, that’s 55 bucks a DAY, or 1650 a month, just keep pace. Dave Ramsey can fuck right off when it takes 32 hours at minimum just to stay as poor as you always were.

No debt has worked for me. I don’t care for him and any of his advice, but getting out of debt has been great for me.

Going by your comments, you’re hardly a struggling gen-z though. When you or I run in place, we’re already miles ahead of those who can barely get off the starting line.

But you were in debt, and the example given of a home mortgage is pretty definitively a debt worth taking on, as rent and increasing housing costs will easily outpace accrued interest.

You should pay that debt down quickly, unless you’re mortgage rate is crazy good and investment returns are crazy high, but that’s not usual. But taking on a mortgage is about the only way you can get into owning a house except for being a trust fund baby.

Some people may have to suck it up and tolerate a car payment, of they can’t afford a 6 to 9 thousands dollar car, because they need transportation to get to work, and any car cheaper than that will be very expensive to repair.

Carrying over any balance on a credit card? Yeah, that’s always a terrible idea.

His no debt spiel is really only get a mortgage once you have no other debt.

The second job thing is interesting, it’s like he doesn’t understand that the economic situation of a society as a whole (generally a country) dictates what % of people can afford to have nice things.

As a result of that, if your society is in a bad economic situation it may very well be the case that even if everybody was working the same number of multiple jobs, advocating for themselves, and busting their butts, most of those people are still going to be in a shitty situation due to things entirely out of their control. Furthermore, the ones that got out of the shitty situation, even though they’re doing all of the same things, only did it due to dumb luck / being in the right place at the right time.

I work 60 hours a week and had to move an hour outside the city to find a townhouse I could afford. And I’m one of the lucky ones.

Set him up with a whiteboard and feed him actual, real figures and watch him fail to explain how it would be possible to do what he’s claiming.

No financial gifts or inheritances from parents to use as a deposit, no magical income that comes from starting a business, no magical windfalls from putting house deposit savings into the stock market, just regular old income and student debt.

If he can’t do this, he should be ignored by the financial media.

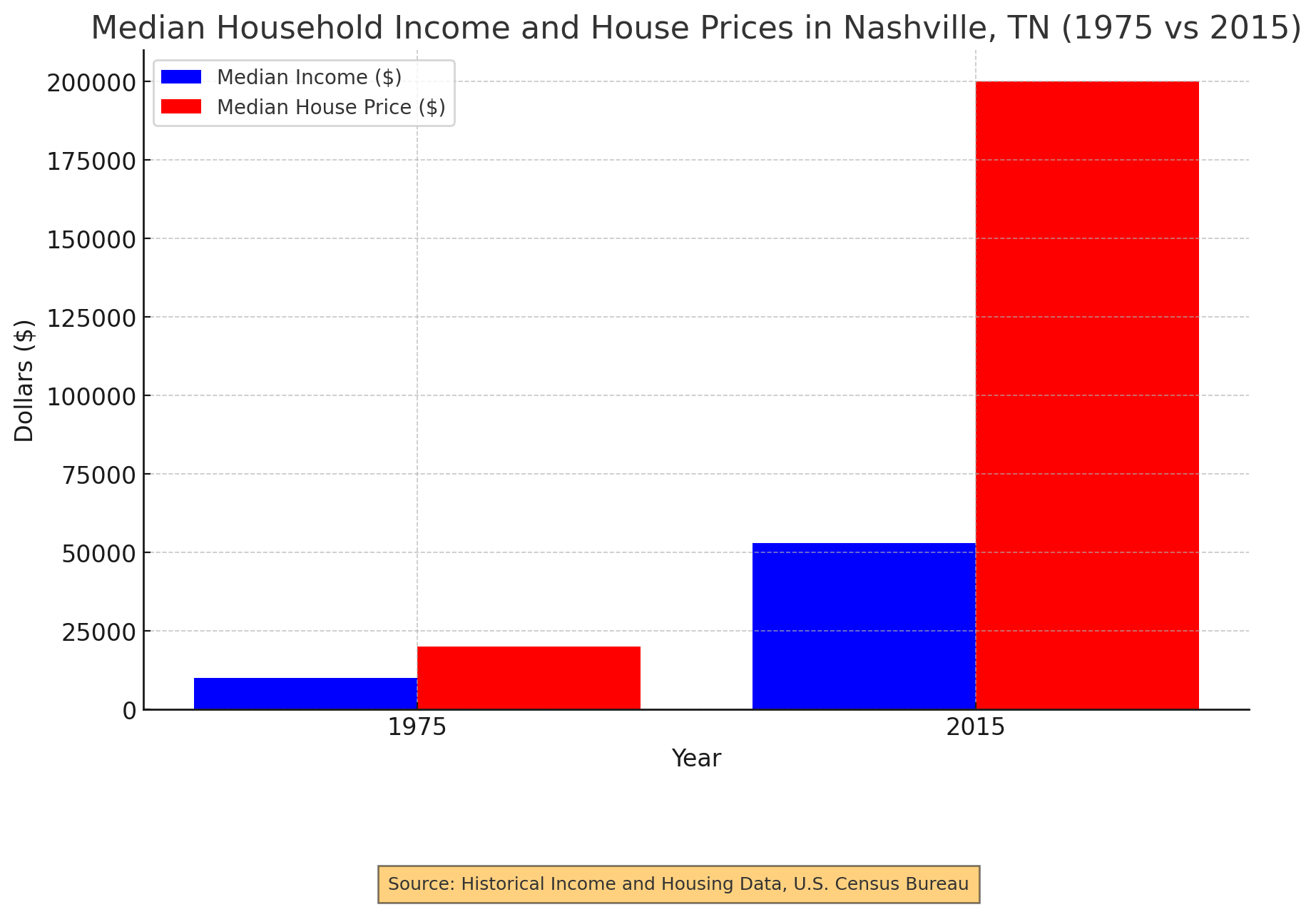

Here’s a little graph I whipped up. Dave Ramsay was born in Nashville, in 1960. So he would have been a little too young to buy in 1975, but you get the general idea.

He’s just going to say invest in stocks to amplify your income.

Add to that, house prices have doubled since 2015. That’s a decade old at this point.

Dude thinks you can pull 8% a year from your retirement and be fine. Everything he says should be disregarded.

https://earlyretirementnow.com/2023/11/12/dave-ramsey-8-percent-withdrawal-rate/

I’ve worked with a number of financial people, and if they talk for free, generally that’s what they’re worth to pay them.

This guy was born into a wealthy family and acts like he earned it all

Big Trump energy.

They always do. Its frustrating and disgusting.

Cut him some slack, the silver spoon up his ass he was born with is surely causing some pretty incredible irritation after all these years - can’t expect him to think clearly all the time.

something something boot straps…

deleted by creator

“fiance guru” isn’t a real job. Fight me.

Finance guru vs. Jiu-jitsu guru…

They’re a joke, they literally produce nothing. O I made one number bigger. Congrats you’re a counter.

I hereby encourage anyone encountering him to slam him as well.

Literally though. If possible, off the top of a cage and through a table, but at least a decent scoop slam.

Buh gawd

Then Randy Savage breaks out the steel chair, right?

In an ideal world :)

Eat the rich.

With some fava beans and a nice Chianti.

I’m fine with just throwing them in a wood chipper, personally.

Feet first, of course.

Would be ok with that too!

We could study the psychological effects of watching one’s limbs being fed into a wood chipper.

Y’know…for science.

I’m at my parents house for various reasons, and I was actually thinking of moving out this year to be closer to my friends.

And then I had a seizure. And my parents and my sister were instrumental in calling 911 and making sure I didn’t end falling to the ground painfully. They stuck with me in the hospital, and have been incredibly supportive. State law doesn’t even let me drive for 6 months, so they’ve helped immensely with all that. I don’t think I would’ve even known I had a seizure if not for them, and I couldn’t have taken the right corrective measures for my health.

So, from the very bottom of my heart – fuck you Dave Ramsey. Go fuck yourself and shove a rusty cactus up your ass. I’d call him a cunt (which I do not do lightly), but he lacks the warmth and the depth to be one.

Be safe man, hoping for you that it was just a one off seizure and you don’t have a recurrence. You don’t want to deal with full blown epilepsy. My sister has adult onset epilepsy that they can’t really get under control. She can’t drive anymore, has to wear a helmet any time she’s on her feet, and with the ever-changing med cocktail she gets prescribed, it really affects her mental state and mood.

It seems like it was just a one off. There doesn’t seem to be anything clearly wrong neurologically, and my blood sugar was incredibly low at the time. I’m also apparently predisposed to getting seizures at low blood sugar from a condition I have, I was on a medicine at the time which lowered my seizure threshold, and I think another medicine was artificially lowering my blood sugar too. So it was just the perfect storm.

I hope things turn around for your sister :/. That’s absolutely awful. I’m incredibly fortunate, but for a while it was possible that could’ve been me. I hope there’s a miracle cure out there to help.

Glad they were able to help you out.

Thank you!

I’m glad your family had your back, a lot of people can’t do so, and we’re facing generational collapses.

Oh I’m very fortunate. My parents are overbearing but they let me stay without rent and my mom still cooks for us. I’m incredibly lucky, and I wish everyone could fall back on their family like this.

There’s a big problem facing the collective generation, and I sure as hell will help however I can.