It’s a general problem in real estate now; commercial and residential.

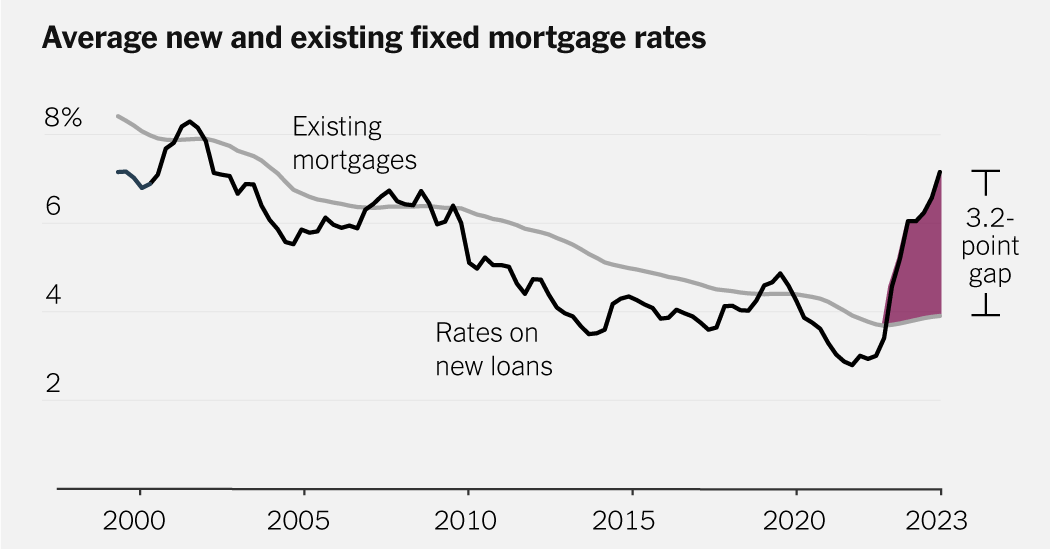

Everyone who was able to refinance to low mortgage rates locked them in. That means that just about anyone who wants to roll over a real estate investment has to take a huge hit in the process. Those rollovers are normally a big part of liquidity and they’ve all dried up.

this is the problem and not people transferring 15% of the housing market into short term rentals.

I told my cousin to pick up a condo he liked in 2019. His cheap ass decided to wait. The condos in that building more than doubled in price and the rates tripled.

I had a similar experience with one of my best friends. In 2019 the market in our town was about to boil over and I suggested he try to find a house before it goes out of his reach. He was upset because there wasnt any more 200k houses that he liked anymore. He thought that it had to come back to that price someday. And then a couple months later, its almost impossible to find a 400k house that isnt a dump. Dude waited too long. He will never find that 200k place in this town now…

2.875 here, my monthly payment is $545. I want to move, but it would be financially stupid to do so

Basically, unless the sale gets you enough to buy the next house in cash, it’s a bad idea, lol.

The value of my house has gone up by about 50% so I could definitely put the money forward, but it still would be a questionable decision.

People forget … If you refinance you are essentially selling the house to yourself with the lower rate, but Mr. Taxman will up your taxes to the current market value of your home, which is ridiculously high right now. Any savings in interest goes back into higher taxes. And now you will need more expensive insurance to cover the increase in home value.

This is not how things work in the US. At least not in the states that I’ve lived in: TX, CA, IL.

My current state, TX, regularly updates the property value assessment, so even if I don’t refinance, my property taxes goes up. With homestead exemption, the rise is capped at 10%, but over 2-3 years, it easily catches up to the market value.

But if you’re in CA or NV, that value assessment increase is capped at something like 2% or 1% annually, respectively. (Proposition 13) Creating situations where homes purchased 20 years ago are still paying really low property taxes compared to today’s buyers.

Isn’t that the way it should be? In Florida it’s capped low per year also…you bet the county raises it the max each year. My 95 year old neighbor has a yearly tax bill of 590, mine was 6k. If I stay in my house 50 years, my tax bill will be 1 tenth that of the new owners too.

Its good and bad. I’m conflicted about it, because I think everyone should pay a fair share of the property tax. The person that moved in 20 years ago and the person that moved in yesterday should shoulder the same amount of burden if their properties are equivalent.

But I also think its stupid that my property tax goes up just because some idiot decided to overpay for the house a few houses down the street.

I simply don’t like the idea that the property tax is tied directly to the appraised value of my house. It should really be tied to the size of the land that I am occupying and the total cost of running the city/county that I am in. If I build a fancy shed (insert any structure here) in my backyard, that shouldn’t really cause my taxes to go up even if it increases the value of my property. The only exception is if I change the dwelling type. If it goes from a single family home to a multifamily unit, then definitely the tax rate should be reevaluated, if it is using the infrastructure more.

Bought my house just before the crash in 2007. Felt screwed over as I went underwater and was stuck with my 6.5% loan while interest rates and home values plummeted (and because my mortgage was privately held, no HARP refi option.

Finally after nearly 15 years not only go out from under water but built enough equity for a no cost refinance. Got into a 2.25% loan.

Sad part is, despite the lower rate, due to skyrocketing insurance and taxes, my payment is no cheaper

Taxes and insurance is what will knock a lot of us out

Had 30 yr 3.84%, refinanced in 2021 to 15 yr 1.999%. it’s the cheapest money I’ll ever have.

I recently gave up my 3% mortgage from 2013 in exchange for a 7% mortgage. It hurts, but it was worth it to get out of Florida.

In the end, my housing costs actually didn’t change that much because my home insurance rates were skyrocketing.

Also home insurance isn’t tax deductible (to my knowledge unless you’re renting the house and then it counts against the income you made renting) but the interest paid is.

That’s a good point, but I’m definitely paying more taxes now than I was before. My new state has income tax and tangible property (vehicle) tax that Florida didn’t have. I looked up tax distribution for my county and the majority goes into education, so I can’t complain too much.

but it was worth it to get out of Florida.

You could put almost any horrific thing in front of that phrase and it sound valid.

I had to keep my arm in a tub of fire ants for 5 minutes, but it was worth it to get out of Florida.

I had to cut off several limbs leading to a bad case of sepsis…

I had to sell a few children (not mine) along the way engage in some other morally questionable activities…

I had to sacrifice my first born like Abraham did his Isaac…

…but it was worth it to get out of Florida

It reads like a country song…

🤌

I could not agree more. The flip side is likely true as well…

“I’d rather put my arm in a tub of fire ants for 5 minutes than move to Florida. “

Its less of a problem of lock in here in Australia. Our rates tend to only be fixed for the first few years. Then you go to the variable rate. We have an opposite problem, where we have what’s known as a mortgage cliff. People who signed up at affordable repayment amounts end that lock in period and have payments jump significantly. Some are forced to sell.

Being locked in seems better than being forced to sell.

Here in Germany you can decide how long you want your rates to be fixed, with the tradeoff being that longer times of fixed rates usually have slightly higher rates (in German its Zinsbindung).

I am lucky and happy that I chose to do 30 years fixed rates, after those 30 years I only have like 2k€ left anyway, so it doesnt matter what rates I get then really.

I would like to introduce you to 2008…

Yes, just America was affectednbynthe global financial crisis. Unless you mean the sub prime rates, which ISNA different thing than fixed rates. Usually those on a sub prime rate are on a higher rate not lower.

We have similar stories to the others, but also, we bought a house in a less-than-desirable town. So even if we could afford a higher mortgage rate, our house isn’t worth enough to move somewhere more desirable.

Kinda strange reading all these comments about how people dislike their house and where they live, but can’t imagine giving up their mortgage rate.

The almighty mortgage handcuffs, the true American dream.

Oh look it’s me. 3.125%

My wife and I LOVE our house and don’t want to leave, but we definitely thought it was going to be a starter home. We straight up could not afford the mortgage payments anywhere else at today’s rates, even in a much smaller house

I couldn’t afford to buy the house I currently live in, today. The “value” of my house almost doubled in value, and interest rates are close to triple what I have now. There is no way my family is going to move out, it’s pretty stupid that an upgrade of a home, in terms of dollar value, would put me somewhere much smaller.

2.75% here. Yeah… I don’t like where I live but I ain’t moving unless I have to

/raises hand

Same story as everyone else. Bought pre-covid, refinanced, now sitting pretty. We desperately want to move, but I would have to make like $50k more a year for the same quality of life.

Rent it out or sell it and move. How is it not a wash for whatever u want to buy?

I don’t know where OP lives or how much their house costs, but a $400,000 home at 3% is around $1,685/month. Same price at 7% is about $2,660/month.

If it were in a more expensive neighborhood, a $1 million dollar home at 3% is about $4,200/month. At 7%, that makes it $6,650/month. Many average houses in California can cost $1.5 million… so needing an extra $50k/year sounds reasonable to be able to move into a similar house.

You have to get a new loan when buying a different house unless you have the money to pay cash. That means you accept the current rate. I wouldn’t want to spend an extra grand or two per month on a similar house.

Because interest rates are way higher now?

Uhh, because of interest rates. The very thing being discussed here.

When we were buying (2019), my in-laws were pushing for us to just get a starter home, and then upgrade in a few years. Both my wife and I were like “no, we’re buying once and being done with.” So we went a little higher than I was comfortable with.

However, our house has increased by 50% since we bought it, and we were able to refinance to 3% during the pandemic. Which was and is fantastic. But, yeah, we don’t even think about moving now.