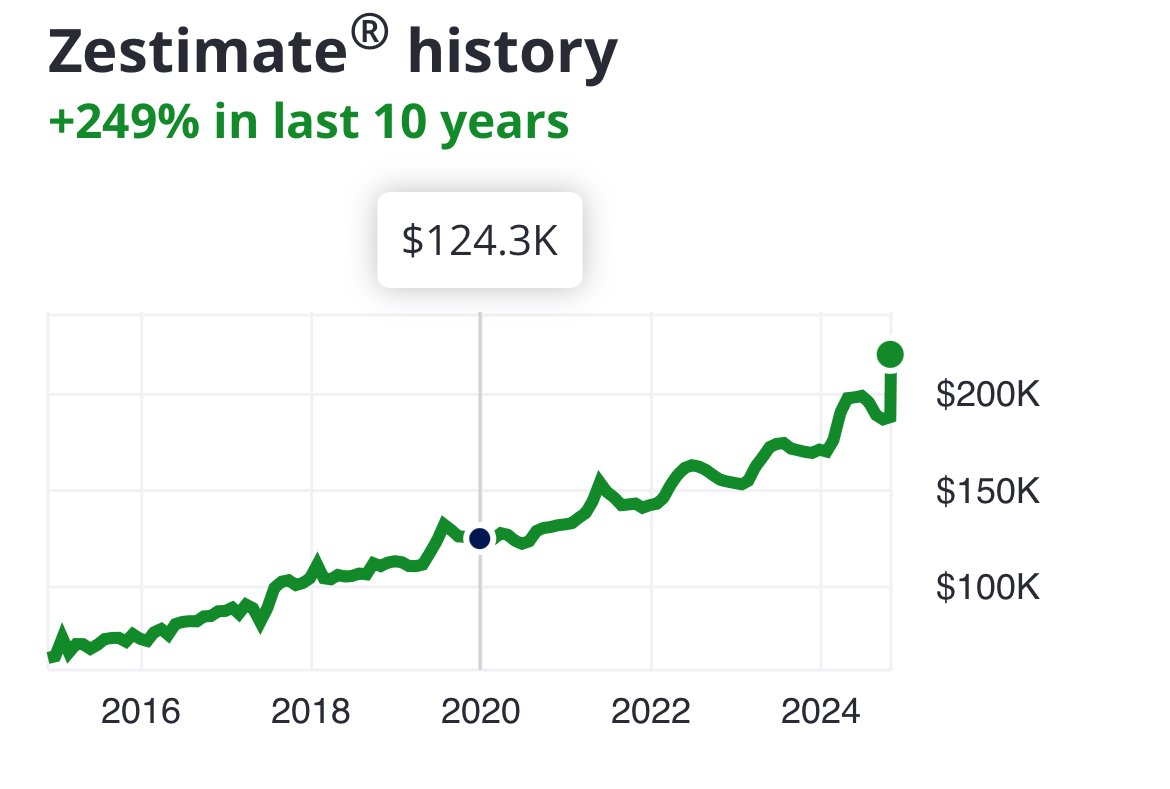

My salary didn’t change at all, but homes went up 82%. The money I saved for a down payment and my salary no longer are good enough for this home and many others. This ain’t even a “good” home either. It was a 200k meh average ok home before. Now it’s simply unaffordable

Tbh this is more than mildly infuriating…

That you don’t understand the realestate market? Or you didn’t know this has been projected for a decade now from millennials getting as old as the avg age of first time home buyers and being the largest % share of the US population creating more demand than available supply?

More like that they probably are too young to have bought a home earlier. All people in their 20s (and I think we make a large percentage of Lemmy users) simply have to cope and buy some overpriced home regardless.

To add to that, we also the only generation who lived thru the only housing bubble giving a hesitation to the concept that realestate has always been the safest investment. They’re buying high but are able to control most of not all extrinsic variables that could keep them from selling higher than they purchased. There aren’t many ways to invest money that you 100% either control the out come of or can insure what you cant control. The exceptions like community wide property value loss are still specific to the properties location that you decide before purchase. I know there are cases where your research before buying can fuck you but it’s still more control than investing in the market where everything about the value of your asset is out of your hands. All you can control is how it’s value is managed.

Houses only increased a little bit. The rest is inflation making your salary 30% less

A little bit… Bahaha Hahaha ya ok guy. Just a little bit

You just need to stop watching Netflix and buying avocado toast.

At least that’s what old people say anyway.

Assuming you spend $10 on avocado toast every day, as well as $75 on eating out for every meal, $20 for Starbucks, and ALSO assuming you have $150 worth of monthly subscriptions:

It will take you 25 years to save one million dollars. That’s assuming you never get sick, never lose a job, never need to buy a car or have major repairs, or basically any kind of surprise expense or setback that could wipe out savings.

To be the richest person on earth, you would need to save that money every year for over 6 MILLION YEARS

Not to devalue your point, but if you truly were spending (10 + 3*75 + 20)*30 + 150 per month (so a total of 7800 USD) and you invest it in an index fund getting back 5%, you’ll have your million in 10 years. 8 years at 10% which is the long-term growth rate of DJIA and S&P 500.

You’ll still never be the richest person in the world, but if you truly were burning away that much money, you could make decent dough just from investing it passively. In 30 years you’d have like 15 million, more than enough to retire.

Now the only real problem is that nearly nobody is actually burning that much cash and the “stop eating avocado toast” suggestions are indeed stupid af.

Can confirme. I stopped drinking Starbucks and now I own a 50 acre plot with a 6 bedroom house on it. If only I would have listened to their Facebook comments sooner, I could have afforded that private jet too. Edit: Apparently sarcasm is lost on a few. So for explicitness - /s

With the Star bucks prices you might as well by a house. Damn they are expensive. People spend like $10 on coffee

I honestly just started going to my own local coffee joint. What used to be expensive for something like a cappuccino (like 7 bucks) is now cheaper than starbucks. Plus I help a small business.

Didn’t think I’d ever see Waleska on Lemmy… but, yeah. This is just the story all over North Georgia right? No one wanted to live in the mountains until all of the sudden you could work from anywhere. Now everyone earning city and suburb pay is happy to live an hour farther out than they were before.

The answer is to go somewhere cheaper. If you go far enough out of town the prices will go down.

Plus when the town grows your property value will go up and up.

This is a boomer logic…

- You are going out so far out that commute arouns trip will start @ 2 hours

- Both people must have reliable vehicles, cost of whivh also spiked. Whats total cost for a reliable vehicle now?

Congrats, you are living a miserable life with mortgage, 2 car notes and commute that destroys your health.

Played yourself really.

Yes this thinking really underestimates the cost of driving and devalues your time.

And as you mentioned, long commutes are uniquely unhealthy.

The answer is to go somewhere cheaper. If you go far enough out of town the prices will go down.

So basically, somewhere no one wants to live because of distasters, is boring AF, no jobs there.

I once lived in a town of around 1,000 people. It had everything I needed in walking distance - a grocery store, doctors office, pharmacy, post office, restaurant, bar, and mechanic. A beautiful bike trail and river ran through the town. Fiber Optic internet was available, and there was a medium-sized town 15 minutes away with good jobs.

I just checked and the average home price is still around 100k. A 2br apartment rents for $750/mo. These places still exist, but they’re called hidden gems for a reason.

Yep, everyone who lives in the less populated areas is miserable and bored constantly. Those poor people, so sad. They should be more like you.

Kind of yes. However if you want home ownership at a reasonable cost that’s the way to go. It doesn’t need to be in the middle of no where but it doesn’t need to be in the upper tier locations.

If it’s boring, then so are you. There’s plenty to do in the country, just not much that involves “going to crowded places and spending ridiculous amounts of money on things that would be 20x cheaper at a regular store”

No argument on anything else though…

Most jobs are located within urban areas and people live around their jobs.

Yes, that’s why I have no arguments against the “no jobs” part.

You’ve never been to a rural area of the country, have you? I traveled to Idaho recently and good fuck was it boring. Hiking is fun for a few days, but then there’s 20 degree weather, snow, ice, hail, poor Internet that’s basically DSL so you can’t play any games or access the Internet. People live within 50 miles of cities for their own sanity

ve never been to a rural area of the country, have you?

I’ve lived in them almost exclusively.

Keep in mind that inflation has risen over 30% in just the last 4 years, which explains at least part of the rise in prices. I wouldn’t be surprised if inflation is even higher in certain areas of the country. I’d also not be surprised if Georgia is getting a lot of natural disaster refugees from places like Florida.

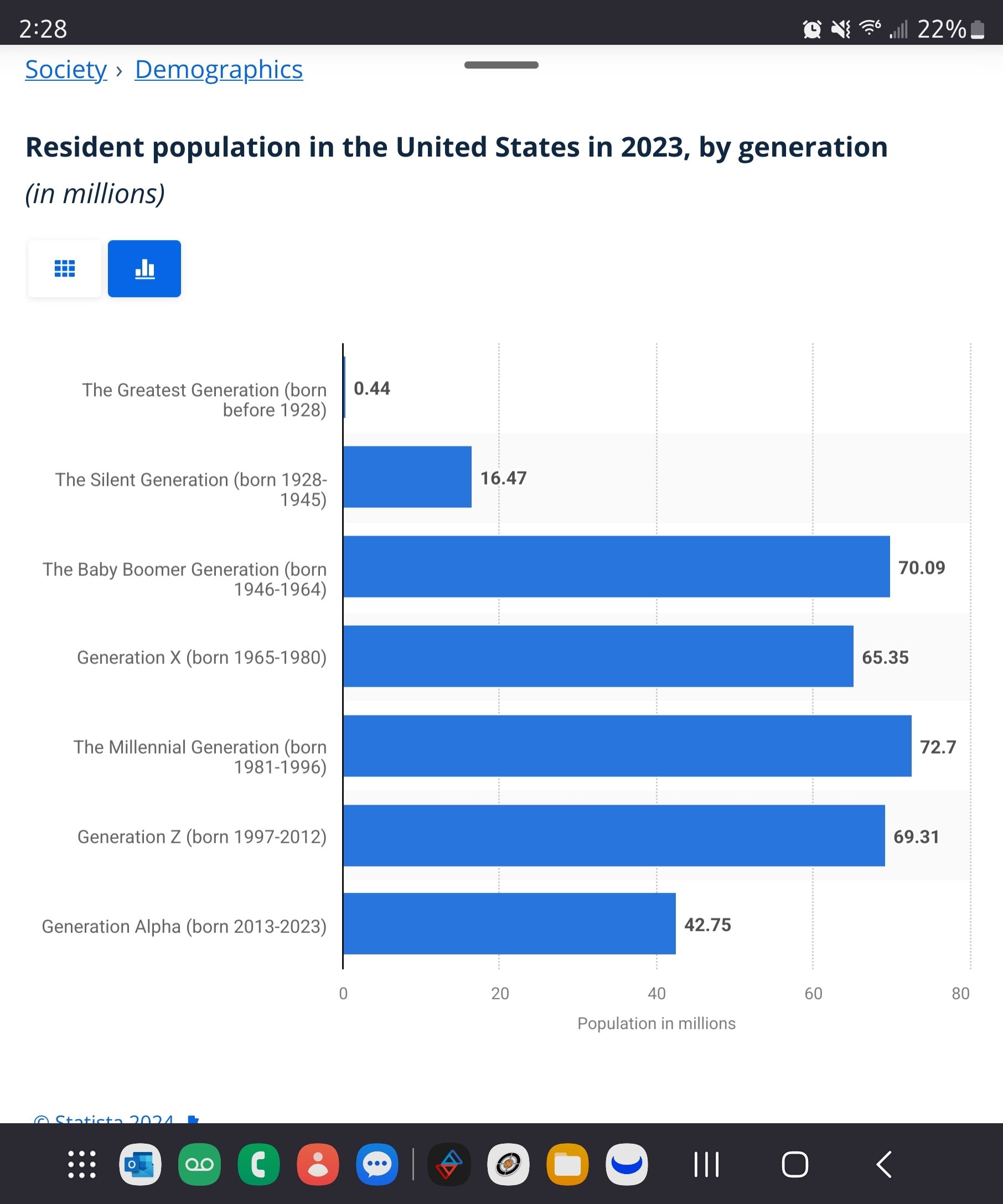

The other part i don’t see anyone mentioning is that this was all projected as a result of millennial generation, the largest % of population by generation comparison, came into the age of buying homes. Creating a sharp spike in demand over supply.

If the house hasn’t changed, then the value is basically the same.

The price change is more about how rapidly the USD is devaluing.

Between 2020 and 2024 there was about 22% inflation. 1.22x$195,400=$238,388. So there’s still over $110,000 of price inflation to account for past devaluation of the dollar.

there was about 22% inflation

I’m not disagreeing with you, but I just wanted to note that inflation numbers (more specifically, the CPI) is an average across multiple industries - supermarkets, rent/mortgage, furniture, cars, flights, health care, and several more. It’s possible for inflation to affect some industries much more than others and I wouldn’t expect everything to all go up at the same rate.

That’s true and worth noting. The difference is much starker when the benchmark is food and fuel, since real estate (and stocks) rose much higher compared to other things.

Has the population jumped up for ya guys?

Don’t know about them specifically, but it seems that more than anything real estate investors are just grabbing as many properties as they can find, whether they can get tenants or not. A house goes up for sale and it’s bought sight unseen by a company almost instantly.

That’s crazy

Yes the largest generational share of the population is the millennials most of whom are just becoming the age of the average first time homebuyer. Creating a sharp spike in demand for realestate.

Ya but does that happen with every generation then? Having a sharp spike of first time homebuyers.

Most millennials would be buying homes already. The end of the millennial group is coming up on 30 so I wouldn’t expect them to be the driving force for first time buyers when so many are already established

I’ll have to look it up to he sure but I wanna say millenials were the largest population increase for a generation since the boomers. Which would make up the really close to the entire existence of the eealestate market as we know it. Wanna say 1930’s the new deal created the foundation of the modern mortgage loan. Either way, the answer is no it does not go up for every generational transition.

It’s actually only the second time it has and will go up by the time gen z cycles to home buying in a span longer than 150 years.

I wanna say you were thinking of this in terms of total population growth increasing but it really is more of a combo between birth rate and poulation percent change, except instead of year over year it is 15 year wondow over 15 year window or however long each generational span is.

Friend of mine was saving up for a house 5 years ago. Prices have gone up almost 150%

Only 37 more years until he has that down payment.

Yeah that was me too… I FINALLY got to the point where I could realistically start looking, got the pre-approval and everything just after COVID started… People had already starting WFH and moving away from where they worked and investment companies kept buying and now I’m still living in someone else’s garage because prices went through the roof pretty much as I was looking…

Of course once you mention WFH everyone gets defensive and claims this was a trend, but those charts are the same everywhere. Houses in 2018-19 were often less than half of what they cost now…

WFH is a logical thing to imagine, but there’s a simpler trend that can be seen by looking at two graphs:

https://fred.stlouisfed.org/series/M2SL

https://fred.stlouisfed.org/series/MSPUS

“Please don’t melt the economy” printing press fired up in 2020 and real estate investors seemed to get plenty of that cash. While inflation didn’t quite match the M2 injection, anything “investment” like saw that bump. The M2 injection was enough to save the stock market, but housing, which did not see the same crash as stocks, got the same boost.

This is why, more than ever, people see that individuals almost don’t get to participate and big companies are instead buying the stuff and maybe letting people rent them if they feel so inclined. The big companies got the boon of the M2 and most individuals got a modest bump by comparison.

printing press fired up in 2020 and real estate investors seemed to get plenty of that cash.

Maybe I’m just ignorant, but in a just world that should have never been allowed to happen… I’m sure our politicians had nothingggg to do with that “oversight.” :/

Thanks for the links!

Generally speaking, one would have hoped for a better solution. To be fair though, we faced an unprecedented scenario in 2020, and for many of the indicators, the closest to precedent that we ever had was the Great Depression. So they did manage to dump truck enough money into the market to patch up the catastrophic drop of the stock market, and provide enough to keep the every day economy vaguely functional. Unfortunately the ‘fix’ was still very ‘trickle down’ style and ended up with an enduring imbalance favoring those already wealthy rather than some alternative that might have left folks on a level playing field.

This is because venture capitalists are buying all the homes to rent

Said it before: no corporation except non-profits focusing on housing should own retail property.

:laughs in Australian:

mine is now worth 130% of its original value

So occasionally I look out of curiosity and the reason is pretty plain.

I look for houses for sale in a suburban area as public listings, and there’s like 1 within a few square miles of the area.

I switch over to renting, and there’s like 12 houses just like the one for sale available, all owned by companies. I also know a coule that aren’t listed that have no tenants, but are still owned by one of those companies. You can tell because those yards are now waist deep grasses (in an area where HOA throws a hissy fit if your yard looks just a smidge unkempt).

Don’t know why the companies find it more profitable to buy houses people aren’t looking to actually move into, at least at the rent they are willing to accept. If I fully understood why, it might just piss me off more. Like maybe the houses work better as a loan basis than other assets, so even empty and unused they are valuable as some sort of financial trick.

Don’t know why the companies find it more profitable to buy houses people aren’t looking to actually move into, at least at the rent they are willing to accept. If I fully understood why, it might just piss me off more. Like maybe the houses work better as a loan basis than other assets, so even empty and unused they are valuable as some sort of financial trick.

That’s one thing, but housing has been a low-risk investment for a long, long time. If they bought the house OP posted in 2020 and sold it in 2024 they would have almost doubled their money even without renting it out.

My understanding is that these companies are investment companies that need stable assets for their billions of dollars portfolios and they actively look to keep buying property as a stable form of appreciating asset. They have so much money that needs to find some way to make more money for their investors.

It’s the same in Kansas City. I just checked a random house in my city and it’s up almost $100k in 4 years.

3bd, 1bath 976 sqft

My janky duct tape together house I bought in 2010, that was built in '58 was 98k. In 12 years I sold it at 280k, with it still technically being out of code. My house was the cheapest sold in the neighborhood, some selling for 320k. It’s insane.